|

Data fields |

Scroll |

Thereforeâ„¢ Smart Capture is pre-trained to recognize the following data fields.

Section |

Data field |

Description |

Basic Information |

Invoice type |

Type of invoice |

Invoice language |

Language of the invoice |

|

Invoice Number |

Number of the invoice |

|

Order Number |

Identification number of purchase order |

|

Customer ID |

ID number assigned to a customer registered in a supplier’s accounting system |

|

Issue date |

Invoice date of issue |

|

Due date |

Due date of invoice payment |

|

Tax point date |

Date of taxable event |

|

Payment Instructions |

Account number |

Number of bank account |

Bank code |

Bank code identifying bank and branch location |

|

IBAN |

Bank account number in the IBAN format |

|

BIC/SWIFT |

BIC or SWIFT code of bank |

|

Terms |

Payment terms specified on invoice (e.g., 30 days upon receipt) |

|

Constant symbol |

Statistical code regarding payment order |

|

Payment reference |

Used by the supplier to match the payment received against the invoice |

|

Specific symbol |

Payee ID (e.g., on the payment order) |

|

VAT & Amounts |

Amount Due |

Final amount (including tax after deducting all discounts and advances) |

Total without tax |

Base amount (for tax calculation) |

|

Total tax |

Total amount |

|

Amount Rounding |

Remainder (after rounding up total amount) |

|

Amount Paid |

Amount that has been paid |

|

Currency |

Currency of the invoice |

|

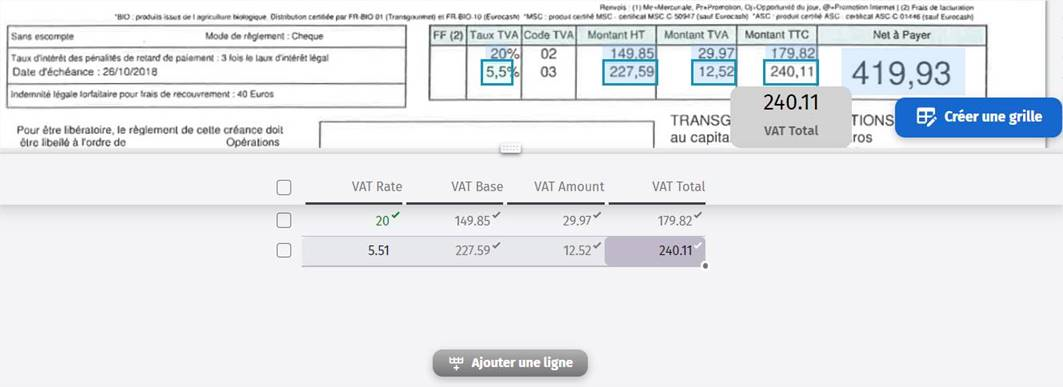

VAT Rate* |

One of the tax rates (in the tax breakdown) |

|

VAT Base* |

Sum of tax bases (for items with the same tax rate) |

|

VAT Amount* |

Sum of taxes (for items with the same tax rate) |

|

VAT Total* |

Total amount including tax (for all items with the same tax rate) |

|

Vendor & Customer |

Vendor Name |

Name of supplier |

Vendor Address |

Address of supplier |

|

Vendor Company ID |

Business- or organization identification number of the supplier |

|

Vendor VAT Number |

Tax identification number of the supplier |

|

Customer Name |

Customer’s name |

|

Customer Address |

Customer’s address |

|

Customer Company ID |

Customer’s company identification number |

|

Customer VAT Number |

Customer’s tax number |

|

Line items table |

Code |

E.g., SKU, EAN, a custom code (string of letters/numbers), or a line number |

Description |

Description of line item |

|

Quantity |

Quantity of the item |

|

Unit of measure |

Unit of measure of the item (kg, container, piece, gallon, etc.) |

|

Unit price without VAT |

Unit price without tax (primary unit price extracted) |

|

VAT Rate |

Tax rate for the line item |

|

VAT |

Tax amount for the line. (E.g.,: tax = rate * amount_base). |

|

Unit price |

Unit price with tax. (E.g., amount = amount_base + tax). |

|

Total Base |

The total amount to be paid for all items, excluding tax. (E.g., amount_total_base = amount_base * quantity). |

|

Total amount |

The total amount to be paid for all the items, including tax. (E.g., amount_total = amount * quantity). |

|

Other |

An unrecognized data type |

* Example: Please see the example below for Multi-VAT figures within an invoice. In this example, 'VAT Total' is sum of the 'VAT Base' and the 'VAT Amount'.

|

Note:

Labeling of data fields related to tax may vary depending on country or region. |