|

Data fields |

Scroll |

Thereforeâ„¢ Smart Capture's Accounts Payable and Receivable engine is pre-trained to recognize the following data fields.

Section |

Data field |

Description |

Basic Information |

Invoice type |

Type of invoice |

Invoice language |

Language of the invoice |

|

Invoice Number |

Number of the invoice |

|

Order Number |

Identification number of purchase order |

|

Customer ID |

ID number assigned to a customer registered in a supplier’s accounting system |

|

Issue date |

Invoice date of issue |

|

Due date |

Due date of invoice payment |

|

Tax point date |

Date of taxable event |

|

Payment Instructions |

Account number |

Number of bank account |

Bank code |

Bank code identifying bank and branch location |

|

IBAN |

Bank account number in the IBAN format |

|

BIC/SWIFT |

BIC or SWIFT code of bank |

|

Terms |

Payment terms specified on invoice (e.g., 30 days upon receipt) |

|

Constant symbol |

Statistical code regarding payment order |

|

Payment reference |

Used by the supplier to match the payment received against the invoice |

|

Specific symbol |

Payee ID (e.g., on the payment order) |

|

VAT & Amounts |

Amount Due |

Final amount (including tax after deducting all discounts and advances) |

Total without tax |

Base amount (for tax calculation) |

|

Total tax |

Total amount |

|

Amount Rounding |

Remainder (after rounding up total amount) |

|

Amount Paid |

Amount that has been paid |

|

Currency |

Currency of the invoice |

|

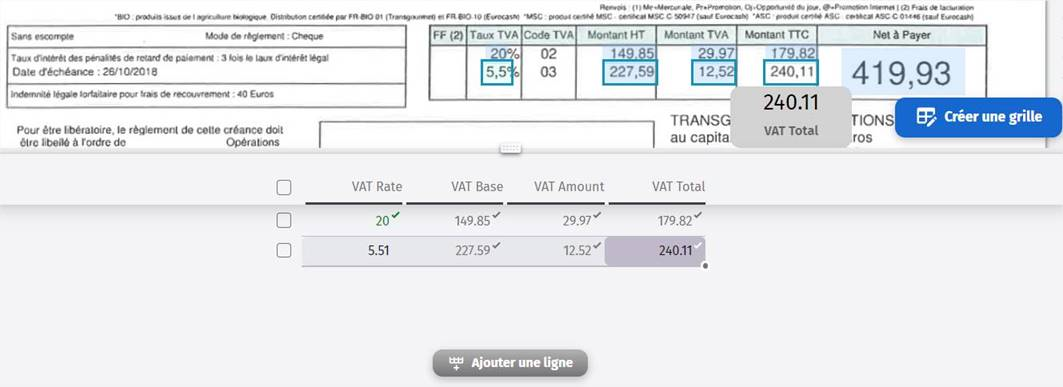

VAT Rate* |

One of the tax rates (in the tax breakdown) |

|

VAT Base* |

Sum of tax bases (for items with the same tax rate) |

|

VAT Amount* |

Sum of taxes (for items with the same tax rate) |

|

VAT Total* |

Total amount including tax (for all items with the same tax rate) |

|

Vendor & Customer |

Vendor Name |

Name of supplier |

Vendor Address |

Address of supplier |

|

Vendor Company ID |

Business- or organization identification number of the supplier |

|

Vendor VAT Number |

Tax identification number of the supplier |

|

Customer Name |

Customer’s name |

|

Customer Address |

Customer’s address |

|

Customer Company ID |

Customer’s company identification number |

|

Customer VAT Number |

Customer’s tax number |

|

Line items table |

Code |

E.g., SKU, EAN, a custom code (string of letters/numbers), or a line number |

Description |

Description of line item |

|

Quantity |

Quantity of the item |

|

Unit of measure |

Unit of measure of the item (kg, container, piece, gallon, etc.) |

|

Unit price without VAT |

Unit price without tax (primary unit price extracted) |

|

VAT Rate |

Tax rate for the line item |

|

VAT |

Tax amount for the line. (E.g.,: tax = rate * amount_base). |

|

Unit price |

Unit price with tax. (E.g., amount = amount_base + tax). |

|

Total Base |

The total amount to be paid for all items, excluding tax. (E.g., amount_total_base = amount_base * quantity). |

|

Total amount |

The total amount to be paid for all the items, including tax. (E.g., amount_total = amount * quantity). |

|

Other |

An unrecognized data type |

Thereforeâ„¢ Smart Capture's Certificates of Analysis Engine is pre-trained to recognize the following data fields.

Section |

Data field |

Description |

Basic Information |

Issue Date |

Issue date of the certificate in DD/MM/YYYY format |

Sample ID |

Sample identifier usually assigned by a laboratory |

|

Purchase Order |

Purchase order number |

|

Supplier Name |

Name of laboratory who performed the analysis |

|

Product Code |

Identifier of the product |

|

Batch Number |

Batch number / Lot number of the product |

|

Manufacturing Date |

Manufacturing date in DD/MM/YYYY format |

|

Parameters |

Description |

Description of a measured parameter |

Result |

Result of the analysis, usually a number |

|

Unit of measurement |

Unit of measurement. E.g. mg, kg, 100g/ml , g/100 ml, °C, % |

|

Method |

Method code or description |

|

Parameters 2 |

Description |

Description of a measured parameter |

Result |

Result of the analysis, usually a number |

|

Unit of measurement |

Unit of measurement. E.g. mg, kg, 100g/ml , g/100 ml, °C, % |

Thereforeâ„¢ Smart Capture's Chinese Invoices Engine is pre-trained to recognize the following data fields.

Section |

Data field |

Description |

Basic Information |

Machine Code |

Machine code |

Invoice Code |

Invoice Code |

|

Invoice Number |

Invoice Number |

|

Check code |

This is a verification code that proves the authenticity of the invoice |

|

Invoice date |

Invoice date of issue |

|

Remarks |

This field captures all information in the notes section of an invoice

Purchase order number Supplier code Order number Check code Handwritten notes Note about the total quantity and weight Address Date and Import method (by air, sea, etc) Payment terms Customer number Date of shipping Discount Contract number Serial number Construction name Construction location |

|

Payment instructions |

Sender bank name |

Bank name of the seller |

Sender account number |

Account number of the seller |

|

Buyer bank name |

Bank name of the buyer |

|

Buyer account number |

Account number of the buyer |

|

VAT & Amounts |

Total without tax |

Base amount for tax calculation |

Total tax |

Total tax amount |

|

Amount due |

Final amount, including tax to be paid |

|

Currency |

Currency of the invoice |

|

Vendor & Customer |

Seller name |

Name of the seller |

Seller VAT number |

VAT identification number of the seller |

|

Seller address |

Address of the seller |

|

Seller phone |

Phone number of the seller |

|

Buyer name |

Name of the buyer |

|

Buyer VAT number |

Buyer VAT Number |

|

Buyer address |

Address of the buyer |

|

Buyer phone |

Phone number of the buyer |

|

Line items |

Description |

Description of the item |

Model |

The model number or code |

|

Quantity |

Quantity of the item |

|

Unit |

Unit of measure of the item |

|

Unit price |

Unit price without tax (this is the primary unit price extracted) |

|

Total amount base |

The total amount to be paid for all the items, excluding tax |

|

VAT rate |

Tax rate for the line item |

|

Total tax |

Tax amount for the line |

* Example: Please see the example below for Multi-VAT figures within an invoice. In this example, 'VAT Total' is sum of the 'VAT Base' and the 'VAT Amount'.

|

Note:

Labeling of data fields related to tax may vary depending on country or region. |